With all this talk about the stock market being at or near a four-year high, Electrical Marketing's editors thought it would be interesting to see if the stocks of 30 well-known publicly owned electrical manufacturers, distributors and contractors have also been marching to the top of the market. We analyzed how stocks are doing now compared to their 52-week highs and where they are compared to the start of 2012.

The results are definitely a mixed bag, with about half of the 30 electrical stocks we checked out doing as well as the major market indices. Year-to-date (YTD), the Dow Jones Industrial Average is up 9% through Sept. 18, while the NASDAQ Composite is up 12% and the S&P 500 is up 14% The NASDAQ and S&P 500 have undoubtedly gotten a big boost from Apple Inc., which is up 71% YTD, and topped $700 per share for the first time ever earlier this week.

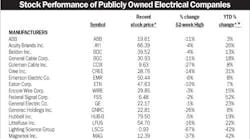

As you can see in the chart on page 2, 16 electrical stocks are beating the Dow's YTD percentage growth, led by Federal Signal (+52%); Magnetek (+42%); Cree (+31%); Acuity (+26%); Pentair (+26%); GE (+23%); Littelfuse (+22%); Philips Electronics (+20%) and Hubbell (+19%). So far this year, the electrical stocks underperforming the Dow YTD include LED manufacturer Lighting Science Group (-42%); Houston Wire & Cable (-13%); Nexans SA (-8%); and Rockwell Automation (-5%).

It's interesting to note that although the Dow Industrial Average was near its 52-week high on Sept. 18, all 30 of the electrical stocks in this analysis were under their 52-week highs on this date, and 16 of them were under by 10% or more.

Several publicly held distributors that were on the “buy” lists of many Wall Street analysts over the past few years are working to scale the market heights they hit this past spring. WESCO and W.W. Grainger are up 13% and 12% YTD, respectively, but they their stock prices are down 10% and 8%, respectively, since 2Q 2012. Fastenal's share prices are having a rougher go of it this year and are currently 21% off their 52-week high and haven't increased at all since January. However, Fastenal's stock price has still more than doubled since Feb. 2010, when it dipped below $20 per share. During Fastenal's march to the $40-level, many Wall Street analysts were cheering on this distributor of MRO supplies. They were also watching WESCO closely for much of the same time period. The company, which went public in 1999, has lit up the stock charts over the past four years. It has climbed more than 400% to the $60 per share level since dropping to $11.89 in Nov. 2008.

It's also interesting to note that the chart below doesn't have two long-time stalwarts of the publicly held electrical stocks community — Thomas & Betts Corp. and Cooper Industries, which were acquired earlier this year by ABB and Eaton.