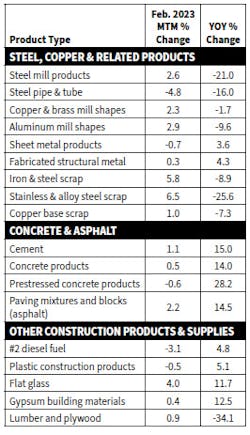

The electrical market is not the only segment of the construction industry that has dealt with huge price increases and volatile price changes over the past two years. In the Producer Price Index data for February published by the U.S. Bureau of Labor Statistics, other categories have had some big changes, including asphalt and concrete (See chart). Lumber and plywood pricing was the most volatile with a -34.1% decline.

According to an analysis of the February PPI data by the Associated General Contractors of America, the price of materials and services used in nonresidential construction increased by +0.4% from January to February, outpacing the +0.1% increase in contractors’ bid prices.

AGC officials urged the Biden Administration to rethink planned Buy America limits on the materials firms can use on a broad range of projects that will make many key materials even more expensive.

“This price report shows that construction costs are not necessarily settling back to ‘normal’,” said Ken Simonson, the association’s chief economist in the release. “A resurgence of prices for glass, metals, cement and paving materials suggests many projects may get more expensive in coming months.”

AGC executives said the mild overall reading for input costs masked substantial price increases from January to February for several key building blocks. The price index for flat glass soared by +4%, the largest one-month increase in 40 years, while the index for asphalt paving mixtures and blocks climbed +2.2% in February. The index for cement rose for the ninth-straight month, by +1.1%.

Several materials used in the manufacture of electrical products also saw some marked increases in February. The index for steel mill products jumped +2.6% following eight consecutive monthly declines. The index for copper and brass mill shapes rose for the fourth month in a row, by +2.3%, while the index for aluminum mill shapes posted a +2.9% rise, on top of a +3.3% spike in January.

The AGC analysis said this diverse set of price increases outweighed decreases in a few inputs that benefited from a recent drop in oil and natural-gas prices. The price index for diesel fuel fell -3.1%. The index for truck transportation of freight slid -0.8% and the index for plastic construction products declined -0.5%.

AGC association officials said the Biden administration’s proposed Buy America requirements will severely limit construction firms’ ability to procure key construction materials and contribute to new inflationary pressure on the cost of those items. AGC executives urged the administration to rethink its proposed Buy America regulations for recipients of federal construction funds to align with the rules that apply to direct federal projects.

“Limiting the availability of materials used on the billions in federally funded construction projects planned for the coming years will needlessly inflate the cost of construction and contribute to broader inflationary pressure,” said Stephen Sandherr, the association’s chief executive officer. “Instead, they should allow for the same kind of flexibility on federally-funded state and local projects that exists when the federal government procures its own construction projects.”