It looks like a good chunk of any growth in the 2017 electrical construction market may come from the single-family construction market, which several construction economists recently pegged as a growth niche for the overall U.S. economy in 2017 and 2018.

The National Association of Home Builders (NAHB), Washington, D.C., sees single-family construction increasing 12.3% and 14.9% in 2017 and 2018, respectively. It also expects the slowdown in multi-family construction, which began this year on a national basis, to continue over the next two years, dropping -0.7% in 2017 and -4.2% in 2018. Two economists at the recent 2017 Dodge Outlook Conference in Washington, D.C., said a key driver for the residential surge will be the increase in the number of Millennials broaching 30 years of age, traditionally a key time for the younger generation to buy their first houses.

Cristian deRitis, senior director, Moody’s Analytics, told conference attendees the demographic trends and pent-up demand for housing because of supply constraints should push single-family housing well past its current annual rate of 800,000 to over one million starts per year, a level the market hasn’t seen since before the Great Recession. He’s definitely bullish on the overall direction of the economy and does not see any severe downturns ahead. “Expansions don’t die of old age. They die because of some jolt or imbalance in the economy,” he said at the Dodge Outlook Conference.

Bob Murray, chief economist and vice president for Dodge Data & Analytics, believes single-family construction has room to grow over the next few years, in part because of historically low mortgage rates and because a loosening in mortgage qualification standards will help fuel the surge in single-family construction. Both Murray and deRitis sad the one wild card in the single-family growth scenario is the question of whether Millennials will migrate to single-family homes, or if they will prefer apartment/condo living in more urban environments.

At roughly 20% of all sales through full-line electrical distributors, the residential market is an important market segment, but it’s much smaller than the industrial (roughly 30%) or commercial construction (about 27%) segments in the “average” distributor’s business mix, according to distributor respondents to Electrical Wholesaling’s 2017 Market Planning Guide survey. Distributors also reported that the construction of single-family homes would account for 8.2% of their annual sales and that multi-family construction would be 4.2%, with their remaining residential business in renovation, maintenance and repair.

Despite these relatively low percentages, the health of the residential market is still an important indicator to watch because retail and then commercial construction tends to follow new housing developments in the construction cycle. It’s also important for electrical distributors, manufacturers, reps and electrical contractors to watch trends in building permits, because they are an important leading indicator of future residential construction activity.

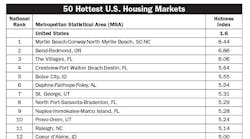

Along with regularly publishing local building permit data, in this issue Electrical Marketing is offering another good indicator for the hottest residential construction markets – the Hotness Index (see chart on page 2) which is the number of single-family building permits per 1,000 residents. This ratio offers an interesting analysis of the impact of potential residential building activity on the economies of local markets of all sizes, while the monthly building permit data published by the U.S. Census Bureau is the place to look if you are interested in knowing where homebuilders are pulling the most building permits.

The hottest housing markets? As you can see in the chart, Florida, and vacation areas along the coast and in the mountains will reign supreme in homebuilding next year.