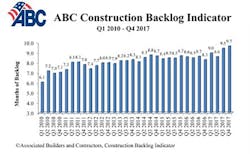

The Associated Builders and Contractors (ABC), Washington, DC, said its Construction Backlog Indicator(CBI) expanded to 9.67 months during the fourth quarter of 2017—its highest level ever and a 2.25 percent increase from the prior quarter. Backlog records were broken in the Northeast region, the commercial/industrial segment and among firms with $30 million to $50 million in annual revenues. CBI is up by 1.36 months, or 16.3 percent, on a year-over-year basis.

“A confluence of factors has produced this result, including still-expansionary monetary policy and accelerating global growth in much of the world, brisk foreign investment in U.S. commercial real estate, surging business/developer confidence, deregulation of certain key industries, higher energy prices, strong consumer spending, a recovering U.S. manufacturing sector and rising spending in a handful of publicly financed construction categories,” said ABC Chief Economist Anirban Basu. “Recently enacted tax reform is likely to serve as an additional tailwind to an already strong construction story.

“As always, there is reason for some concern,” Basu continued. “While 2018 is likely to be a solid year for construction spending, there are grey clouds emerging from the silver linings. A trade dispute with Canada has helped push softwood lumber prices higher. Recently announced tariffs on steel and aluminum may have similar effects. Indeed, inflationary pressures are building in various elements of the economy, including wages, health care, homes, apartments and tuition. The result is an increasingly inflationary economy likely to produce higher interest rates over time. Should interest rates rise too quickly, backlog is likely to eventually decline as fewer developments are green-lighted due to higher borrowing costs.”

In its breakdown by industry, ABC shined a light on commercial and institutional construction, which has an average backlog of 10.1 months, the segment’s highest level in the history of the series. The infrastructure backlog was even longer, at 12.55 months, another record as improving state and local finances helped spur additional public construction in education, public safety, highway/street and transportation.

Meanwhile, in the heavy industrial category, the average backlog fell for a third consecutive quarter. At 5.2 months, the segment’s backlog is down 5.2 percent on a quarterly basis and 5.8 percent on a year-over-year basis.